Downsizing sounds like a failure–we didn’t live up to our dreams.

Maybe we need to see it a different way!

This month we’re looking at doing marriage on hard mode–are we making marriage, and life, more difficult than it needs to be? And one of the biggest things that contributes stress to marriage is financial problems. So today I’d like to take a step back and ask: could downsizing help your marriage? I first ran this post a few years ago, but it stirred quite the conversation then, and I thought it might be time to revisit it–especially because so many people are moving, relocating, or doing work differently as COVID ends.

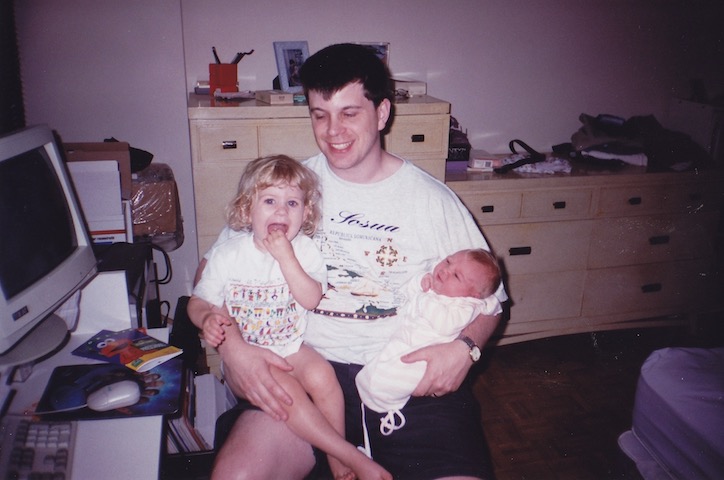

Look at this picture of a typical post-war house:

Small, isn’t it? And yet the majority of North American families in the 1950s lived in something that looked pretty much like that. After World War II, we radically expanded the idea of home ownership. Instead of renting, people bought these little houses, and by and large, they thrived in them.

Was it tight? You betcha. Often three bedrooms with four or five kids, so 2-3 kids would have to share a bedroom. Bunk beds became major furniture items. The living room was small, so people sat on the couch and the floor to watch TV. Kids did homework at the dining room table.

My husband grew up in a house like that: four boys, one bathroom, small kitchen, under 1000 square feet. And they survived just fine.

In fact, I’ve heard it said that the quality of sibling relationship is inversely proportional to the size of the house.

The smaller the house is, the closer kids turn out to be, because they have to play together!

I think that may be true for families as well. When we first had our children we lived in a tiny apartment in downtown Toronto. The kids would get grumpy if we stayed in that confined space too long, so everyday we’d do an errand: the library; a playgroup; the YMCA; the museum on free days. We didn’t spend money, but we got out of the house. And when we went out, the kids had my total attention. They used up a ton of energy. Then, when we got home, they’d play together better and leave me alone a bit more.

When we moved to Belleville and lived in a medium sized house, suddenly it was easy not to go out everyday. And I noticed we were missing something important. So we resumed our habits of daily outings.

We had a great life when we lived in a small apartment, and we were able to save in those days for a small house. But the most important thing, to me, was that we were together more.

What if you’re missing out on relationships and family time that you could have because you’re focused financially on the wrong thing?

Disposable income, you see, is directly related to expenses almost as much as it is to income. Lower the expenses, and your salary is not as much of an issue. Increase the expenses, and you have to work–a lot.

Some of the thorniest reader questions that I get on this blog have to do with work. Someone’s working 60 hours a week at two different jobs, and someone else is working full time as well to pay off debt, and they have no time together and no time with their kids. Both of them work opposite shifts and have no time for sex. They’re in so much debt that they fight all the time and the kids are picking up on the tension.

Money problems can wreck marriage.

But money problems can be the result of choices–choices that we make about what kind of life we want to live.

What if we could decide to live a smaller life? What if living small could actually help us to love much larger?

Let’s do a little thought experiment here to see what I mean. What was the quality of life like for people growing up in those tiny houses or apartments? Of course, so much depended on the family. But the size of the home was not necessarily bad because people adjusted. It was all they knew. Let’s also remember that in most parts of the world, far more people are squeezed into far smaller spaces than even that house represents. We are the strange ones, living with our huge homes. Our grandparents, in these small homes, were not strange. They were more the norm.

What did people do with less space? The kids played in the living room together, or in the basement. They didn’t hang out in their own rooms, away from their siblings. They went outside more since inside was cramped, and thus they got more exercise, even in the winter. They didn’t spend as much time on television, because families usually only had one, and sometimes Mom and Dad would want to watch their programs, and the kids had to scatter. They played board games together. They made Lego. They used their imagination.

And that was okay.

The two biggest choices that we’ll likely make that will impact our expenses are the kind of housing we want and the city we live in.

Yes, some people, no matter how they choose, will always be strapped for money. But the cost of living is so much cheaper in some cities or towns than it is in others. And often the pace of life is very different too. Can we ask ourselves big questions about what kind of life we want to lead?

When you were 13, did you love bridal magazines? Did you stare at the pictures and imagine what your own wedding would be like? Many of us did. But many of us still do–we just replace the bridal magazines with Home & Garden, and we dream of a beautifully decorated, spacious home. We want to have “arrived”.

But what if that space and luxury comes at the expense of massive amounts of your time–or your husband’s time? And what if there’s another way to peace?

Imagine how we could change the culture if we just said, “Enough!”. Enough working round the clock. Enough stress from living beyond one’s means. Enough of both of you working opposite shifts and never seeing each other. What if instead of valuing our lifestyle we valued our lives?

Now, I understand that some people are barely making ends meet on very limited income, and this post is likely not for you.

But I have known so many couples in their twenties and thirties who have bought huge houses in expensive cities when they also have massive student debt, and life is just very stressful. What if they had stayed in an apartment for ten more years–even if they weren’t building a nest egg? Wouldn’t it have been less stress? Or what if they could have moved to a cheaper city?

The Benefits of Downsizing

For some people, the best financial move you can make, and the move that would add so much less stress to your life, is to sell your home and downsize. In Canada, at least right now, real estate prices are through the roof. It is seriously a great time to downsize!

Or maybe it’s not about a home. Could you get rid of a car payment and buy a used car instead? Could you look into how to save money on your biggest monthly expenses, like electricity, insurance, utilities, car payments. Many spouses basically “earn an income” by staying at home and putting a lot of time into saving money, even on things like groceries!

Is downsizing fun? It can be! Think of it like a challenge to make the money last.

Give up some extracurricular activities with the kids, but replace it with fun family time, where you play family board games or have parties every week. Stop going out for dinner and have people over more. All of these things are “fun”.

Our society cannot go on with so many living beyond their means. We are crushed in debt at every level–personal, state, federal. We have built a beautiful society, but it is built on sand. One day it will come crashing down, as it has already begun to. That’s why, when I was raising our kids, one of my biggest aims was to teach them how not to need a lot of stuff. And they both are the best thrift store shoppers and budgeters and planners that I know!

But let’s go beyond just saving money. Let’s ask: can you change your lifestyle so that you can actually enjoy life more?

- Can you downsize your house so you’re not as burdened by debt?

- Can you move to a cheaper neighbourhood?

- Can you move to a whole different city where the cost of living is much lower?

- Can you or your husband stop working an insane job and start a small business that you’ve always wanted to?

- Can you drastically reduce your expenses so that you don’t need to do the shift work anymore?

Because it all comes down to this:

Can money be the vehicle that you help others with, instead of something you’re always desperately worried about?

Again, if you’re already seriously struggling and you don’t feel you have a lot of options, this post is not for you. For many of us, though, changing our habits and our lifestyle could be what helps us live with less stress for the next few decades. Can we dream differently as a society? Can we aim for less, rather than always thinking about moving up? Can quality time with family be our measuring stick, rather than our lifestyle? Just thought I’d throw that out there to think about today!

UPDATE: A Facebook commenter made a good point here: “My ex convinced me to sell our home and pull out the equity and rent. Worst mistake ever. All it did was continue to enable his extremely poor financial decisions.” Yes! This needs to be a decision that you make so that you can be in a better financial position with more breathing room and a better life, not something where you end up doing worse. Financial abuse is a real issue, and if you’re facing this, please see a licensed counselor or call a domestic violence hotline (they can often help with abuse issues even if they aren’t physical).

Tell me in the comments what you think. Have you ever downsized? Have you ever chosen to forego something big? What did it feel like? Let us know!

Marriage on Hard Mode Series

-

- Podcast: Are We Making Marriage Harder Than It Needs To Be?

- 6 Ways You May Be Doing Marriage on Hard Mode

- Identifying the One Thing that's holding back your marriage

- Are You Doing Too Much as a Family?

- Why Downsizing Can Be Worth It

- Podcast: Are We Doing Sex on Hard Mode?

- How Gender Roles Can Make Marriage Harder than it Needs to be

- Dealing with the Primary Breadwinner Stereotype so it doesn't hurt your marriage

- What if Marriage Honestly is Hard?

- 10 Red Flags about Marriage and Sex

Sheila Wray Gregoire

Founder of To Love, Honor and Vacuum

Related Posts

8 Reasons to Go To Bed Before You’re Tired

What if there's something super simple you could do that could improve your mood and your...

When Are Wet Towels on the Bed More than Just Wet Towels on the Bed?

Did you know that 45,000 receive an email from me every Friday with a round-up of things from the...

Let’s Talk About Wet Towels on the Bed

So the wet towels anecdote from Love & Respect has gone big on social media this week. And I...

AGING PARENTS: Splitting Responsibilities with Siblings

What if aging parents need help, but only one child lives near them? This week I’ve been rerunning...

AGING PARENTS SERIES: Setting Boundaries with Aging Parents

How do you set boundaries on how much help you can reasonably give to aging parents? This week I'm...

aging Parents series: You Owe Your Adult Children a Life

If you need your adult children to eventually care for you, then that should factor into an...

5 Questions to Ask Before You Talk to a Woman About What She’s Wearing

"How do I talk to a woman about what she's wearing?" I've received a number of social media...

9 Ways to Help Bare Marriage This Christmas!

I am so grateful to all of you who show up in this community, engage on this blog and on social...

Yes!!! This absolutely resonated with me. My husband and I (no kids) thought we needed a 3br/2ba house on the nice end of town. But we were quickly getting priced out of the housing market, because our incomes weren’t keeping up. We “settled” for a 2br/1ba condo, in a less desirable neighborhood, because it was in our price range, and the complex itself is fairly safe. We’ve been able to keep up with our financial goals *way* better. Even though our condo is only 100sq ft bigger than our apartment was… sometimes it still feels too big just for the two of us.

Great post. Sometimes, it’s not just about quitting a job; it’s about saving for retirement and having an emergency fund. If your car needs new struts or your kid needs to go to the ER, the money is right there. If your boss is crazy and you need to bail to a lower paying job, the math works out.

I’m also going to do “car math.” A lot of people mistakenly think that you don’t “put more into a car than it is worth.” So if your reliable old car is worth $4,000, you wouldn’t put more than a few hundred dollars of repairs into it. But the question is not what your car is worth if you sold it; it is what happens to your car after you repair it. Do you drive for another 50,000 miles without a headache, or will it need another expensive repair in six months? What would you buy with the money you would get from selling it and putting into the repair?

We figured that if we have car loans on reasonable new cars (Nissan, maybe Toyota), we would be spending $8,500 a year in car payments. So spending $2,000 a year in car repairs is a bargain.

Now, why do people finance cars? Instead of paying for a big repair, they trade in the vehicle, put that towards the new car, and have monthly payments that don’t require them to cough up $1,500 by Thursday. Instead of putting down a big chunk of money right now to drive away in a 10 year old car, they put down a smaller chunk of money and drive away in a nice, new vehicle. Except the payments come every single month for 4-6 years.

Good tips here for my future! As a long-time single woman, I highly recommend saving money even in hard times and during those times, I made sure to keep my savings account around $2000 at minimum in case of a financial emergency. I have always believed in living below my means and was raised with the mindset of “If you don’t have the money to buy something, don’t buy it until you have saved up enough money.” In this fast-paced materialistic society we live in (mainly the USA), it can be easy to get caught up in keeping up with the Joneses or the Smiths.

In my first marriage (during my early to mid 20’s), it was challenging to be on the same page financially with my husband. He believed that money grew on trees and that we could get a credit card without consequences. Thankfully, we each had our own credit cards but we shared finances and we agreed to let me manage the checkbook. When it comes to finding the right spouse, I believe it’s important to be equally yoked financially because different mindsets about managing money can cause lots of conflict. Having nosy family members dictate how you should conduct your marriage also doesn’t make things any easier.

I’m curious to know how as a society did we get to a place where many people think that we need to upgrade to a larger home, newer car, more material things, etc.?

Great advice. We moved to a much less expensive area several years ago and we have never regretted it. We even had more kids than we would have been able to if we hadn’t moved! When my husband got a promotion several years ago we didn’t change our lifestyle; instead we started putting money away for college. It feels great to know that if he ever wants to change jobs to something that pays less, he has that flexibility, and that we won’t be panicked when it’s time to start paying for college. The slower pace of this community is a huge difference, too. In our old city everyone was stressed about trying to make ends meet, working long hours, commuting, etc. People really do seem happier here.

Excellent advice, especially for young couples (or singles) starting out. When my husband and I were first married, we rented a really, really small condo. If I was standing in the kitchen doing the dishes (no dishwasher of course!), there wasn’t room for my husband to open the frig door to get a pop. And we had to elbow each other just to get a peek in the bathroom mirror while getting ready for work in the mornings. The tight quarters didn’t bother us at all (especially as newlyweds)! The condo was much less than we could afford, but it allowed us to save for a down payment on a house. Since then, we have moved many times and have always found a house that was affordable on one salary. I can’t say that we’ve never had a money conflict in 30+ years of marriage, but they have been very, very few. I think the biggest reason was that we made a conscious decision to avoid being “house poor.”

Smaller house also means less upkeep and chores, which also translates into more time for what’s really important!

Yes! That’s my favourite part! (On the other hand, when it was super small we did have a hard time keeping it clutter free iwth all the kids’ stuff!)

Even if you are financially comfortable, there are benefits to downsizing. Smaller house = less time spent cleaning!

Also makes it easier to say “no” when the kids want to buy something big. “Sorry, honey, we don’t have space for it.”

Then they learn negotiation skills.

My 6-year-old recently fell in love with a ginormous rocking horse in the thrift store. She actually had the money in her allowance to afford it, and I don’t like using my veto power over their purchasing unless it’s something potentially harmful, but we had no space. I pointed out there was no space for a Clydesdale of a rocking horse in the bedroom she shares with her little sister, and told her she could buy it IF it went in the living room (with other “community property” type toys), AND she shared it with her sister, AND we got rid of the toddler scooter she and her sister had outgrown (but weren’t ready to part with) to make space in the living room. She and little sister were both on board with it, and “Star” has found a second lease on life with us.

We downsized from a 2000 sq ft house to an 850 sq ft apartment (in the arctic so we have a LOT of gear) and I love it for all the reasons you cited.

It’s SO much easier to stay on top of how much stuff we have in our home because there’s fewer places to shove things in a moment of weakness. And I love having less cleaning to do. It’s also made us be really strategic about what our priorities are as a couple and as a family.

Glad you’re having the same experience!

Yes! We chose to rent for the first 10 years of marriage. It enabled us to afford extensive travel, live in a downtown loft for a while and enjoy “city life”, and eventually IVF treatments.

Once our kids were big enough to need a yard, we bought a modest sized home with the intention of “upgrading” in 5 years. When it came time, we looked around and thought, we’re 1/3 of the way into our mortgage, do we want to start over and add another 100k on top? Do we want our kids to grow up thinking bigger and more is better? We stayed and remodeled things that made it a dream home for us. Just today, I had a realtor call and ask if we were interested in selling and I was like, no way! We love our house with small rooms overflowing with love and peace.

That’s amazing! I love it. There can be very valid reasons for upgrading, but everyone just needs to count the cost, because there can be good reasons for staying put.

Loved this piece. You mentioned something similar on last week’s podcast and my husband and I were talking about it last night. We’re in the middle of trying to decide what to do with our living situation. Right now we have a 2bd/1ba 860sqft condo with three kids, 4yo, 2yo and 5mo. So, yeah, it’s getting tight. We would like to move to a 3bd/2ba house with a yard, but it would put a lot more financial strain on our family if we stay in the Boston area. We are torn between staying here or moving 2 hours away. My husband’s industry, biotech, is concentrated in a few high-cost-of-living cities, so we can’t easily move anywhere we want, because moving 2 hrs away he wouldn’t be able to find a similar job with similar pay. My husband works in the lab, so he can’t do it remotely either. Anyway, Sheila your article was helping us to see that what we may gain with a move (space and a yard) might not be worth what we would sacrifice (time, stress, financial constraints).

Can we make it work in our condo? Sure. Is it ideal? No. Does it leave more room in our budget for discretionary spending (travel, activities for the kids)? For sure! Does it keep us close to family and friends? Yes. Do my kids get a yard? No. Can I take my kids in the car and drive to somewhere where they can experience nature? Yes. Is that annoying? Perhaps. If I’m annoyed at my kids and want them out of my hair, can I just send them outside to burn off energy? No. Do I often have to get housework done, and so I can’t take my kids on outings? Yes. Does that mean my kids spend too much time indoors? Maybe. Do my kids treat my living room furniture like a jungle gym? Yes. Does my husband have to commute 2hrs+ a day? No.

It’s a tough decision.

Totally hear you! We lived in downtown Toronto and there were some AMAZING parks a short walk from where we lived ,including a farm with goats, horses, cows, pigs, chicks, ducks, etc. We had a lot of fun there!

Boston has gotten out of control with housing costs and traffic. Maybe consider Durham? Nothing wrong with your husband hanging out in his job now and waiting for the right one in the right city.

For anyone living above their means, downsizing probably is a good idea. But I’d be cautious in hoping that cramming your kids together into a small space will make them best friends.

Kids need companionship, but they also need some space, autonomy and privacy.

They need to learn negotiation skills and compromise, but also need to be allowed to, at least sometimes, meet their own needs instead of thinking about the needs of their sibling-roommate. Sometimes people have conflicting needs. Increasing the chances of that happening tends to increase stress levels.

If it were me, I would pay attention to how a small house was affecting the family. If it was causing harm, see about saving up for an upgrade. Only after being able to afford it, though.

I agree with Maria. My childhood friend was forced to share a bedroom with his two brothers, and they also all had to play together all the time. They fought constantly.

Like many things, a balance is required. Yes, we need to learn to get along with our family, but everybody needs their own space and time once in a while. Depending on budget, of course

I remember our small apartment in downtown Toronto too! We lived there until our oldest was turning 3. We did a lot of walking (just used the car to get groceries and visit our parents) and outings, and basically used the YMCA Family Development Centre as our backyard and playroom. I loved having friends (other medical residents) in the building. When we moved to a new subdivision, we had more space but I had to drive everywhere and I missed the old community.

In the other hand, we may have been better off if we had bought a condo in that building instead of renting. Now that we have paid off our house, we have gained the benefits of a hot housing market while paying only taxes, maintenance and utilities. Our net housing costs were actually higher in that small apartment.